Cash Planning

Introduction

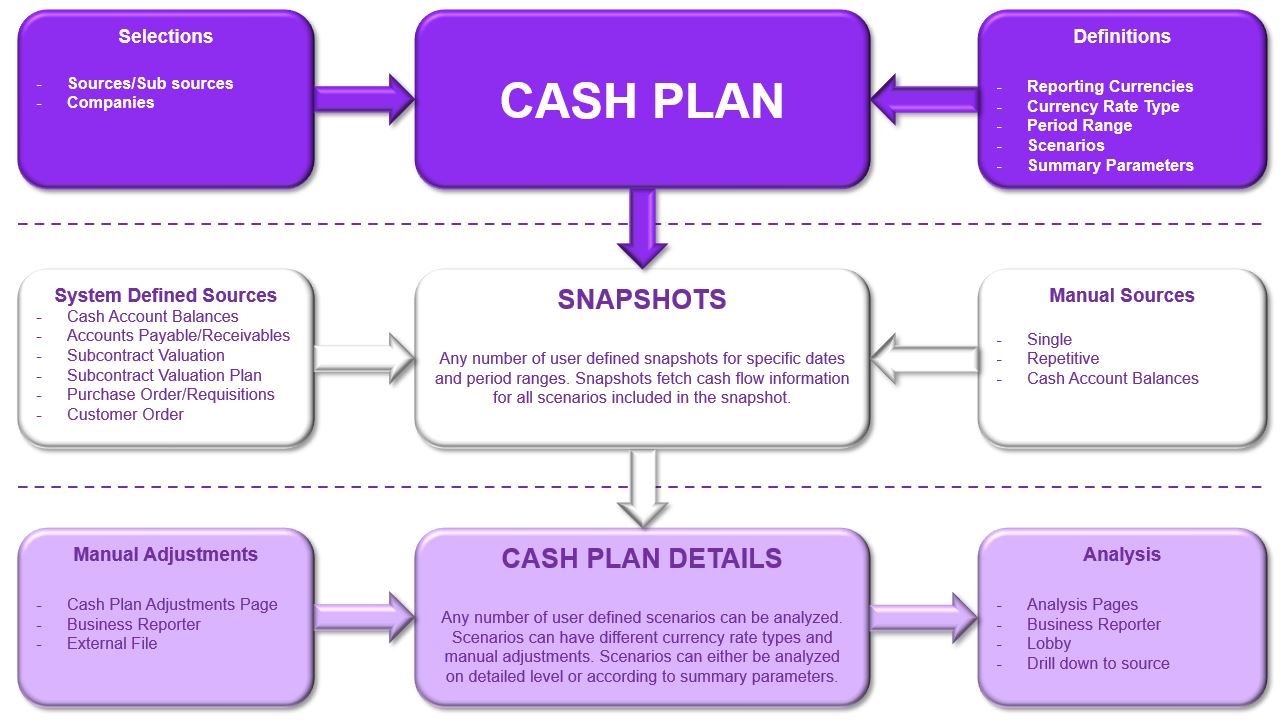

Cash Planning provides capabilities to analyze, plan and consolidate future cash flows within a project, a company, or a group of companies. It can be used both for short term scenarios with input primarily from Finance sources or for longer term scenarios with additional input from other automated or manual sources. The ambition with cash planning is to be able to re-use as much information as possible from existing cash flow sources within IFS Cloud and minimize manual processes.

It is possible to manage and maintain several plans in parallel for different purposes and with different focus. A cash plan is based on different snapshots from connected sources to reflect the situation at a given point in time.

Analysis and reporting is made using analysis pages, IFS Lobby or

Business Reporter based on transaction currency, accounting currency or common reporting currencies.

IFS Cloud 22R1 includes cash flow information from finance, supply chain and

sub contract related sources.

In future releases, additional capabilities are planned to be added.

Cash Flow Sources

A cash flow source can either be connected to a cash plan function or defined for manual input. If the source is connected to a cash flow function it means it will automatically fetch cash flow information from sources within IFS. There will be one system defined source per cash flow function, but it is possible to create additional sources using the same cash flow function if needed. The solution so far includes cash flow functions to obtain information from finance, supply chain and sub-contract management.

Finance

In Finance, there are three different cash flow functions that can be connected to a plan.

- Accounts Payable - Obtains information on supplier invoices and supplier payment documents.

- Accounts Receivable - Obtains information on customer invoices and customer payment documents.

- Cash Account Balances - Obtains balances on accounts connected to payment institutes of the company.

Please note that in order to obtain project and subcontract ID on cash flow information from accounts payable and accounts receivable, the posting information has been used as a base. This means that the same project/contract proportions that exist in the posting information will be used for each installment. In addition, the cash flows from supplier invoices are recognized per project/sub contract even before the posting information are created when project/subcontract information is available.

Supply Chain Management

From the supply chain area, there are three different cash flow functions that can be connected to a plan.

- Purchase Requisition - Obtains information on not yet fully processed purchase requisition lines.

- Purchase Order - Obtains information on not yet fully processed purchase order lines and connected purchase order change orders, charges, receipts, staged payments and payment terms.

Please note that in order to obtain the Project ID on the cash plan information from Purchasing sources the information available on the Purchase Requisition and Purchase Order has been used as a base. Project connection on line level will be considered for all instances, only exception are non-line connected charge lines where the header Project ID will be considered.

Customer owned lines and Intersite related orders are excluded from the purchasing sources. Rental part lines are currently not supported for purchase orders.

- Customer Order - Obtains information on the Customer Order lines which are in all statuses and connected charges.

Please note that in order to obtain the Project ID on the cash plan information from customer order and preliminary customer order invoice sub sources the information available in the customer order invoice or customer order lines have been used as the base. If there is a header connected project, then the relevant project information is visible in the Cash Plan. If there is not any header connected project, the information related to the project is retrieved from Customer Order line and the proportionate calculation is done for each installment.

The Rental part lines and Rebate Invoices are excluded from the Sales Sources.

Sub Contract Management

Cash Planning obtains information on future cash flows related to subcontracts from IFS/Sub Contract Management. The information is divided into two different sources.

- Sub Contract Valuation source covers work registered on a subcontract but not yet invoiced during the valuation process.

Note: When the valuation is partially invoiced the source will be used to give the remaining amount to be invoiced, and once it has been fully invoiced it will no longer belong to this cash flow source.

- Sub Contract Valuation Plan source covers all planned future payments based on the scheduled work on the subcontract which are not covered by the valuations.

Manual Sources

In addition to the sources using automated cash flow functions to fetch cash flow information it is possible to define sources to be used for manual input. For example, salaries or other expenses not yet covered by the existing cash flow functions.

Working with Cash Planning

Cash Plan

A cash plan is defined for a specific purpose. E.g. short term forecast or a monthly review. A cash plan can have several, recurring, snapshots reflecting the situation and forecast at a given point in time.

On cash plan level the general selections and settings of the plan is defined. Here, the user selects which sources, sub sources, companies and cash plan scenarios to include in the cash plan. On this level the user also defines which reporting currencies that should be available for analysis.

At least one cash plan scenario must be defined. The first scenario will be defined as a base scenario. The same set of cash flow information will be fetched into each included scenario when ordering a snapshot. When entering adjustments on the base scenario they will automatically be copied to the other scenarios included in the snapshot. Each scenario can however be translated into accounting and reporting currencies using individual currency rate types. It is also possible to add individual adjustments to each additional scenario.

Snapshot

When the general settings have been defined on cash plan level and at least one scenario exist, it is possible to create and order a snapshot. When ordering the snapshot all future cash flows from the selected sources and companies will be fetched into the cash plan details.

Analysis

The cash plan is analyzed at scenario level. The scenarios can either be analyzed on detailed level or according to summary parameters defined on the cash plan. The summary parameters have been introduced, if needed, to make it possible reduce the number of rows in the table used for analysis. In addition to a number of analysis pages in IFS Cloud, Cash Planning also comes with two information sources, one on detailed level, and one on summarized level.

There are several attributes that can be used for grouping information, e.g. direction (In/Out), cash probabilities, currency codes, etc.There are a number of possibilities on how to group the cash flow dates when reporting. In addition to the standard calendar, accounting calendar and reporting calendar, it is possible to create your own time buckets which is stored on the cash plan transactions.

Analysis and reporting can be made in transaction currency, accounting currency on company level and three different reporting currencies defined on plan level.

Cash Plan Adjustments

When a cash plan snapshot has been created and analyzed it might need adjustments. This can either be done using the cash plan adjustment page in IFS Cloud, through external files or using IFS Business Reporter. Using external files also allows for collecting cash planning information from external sources or from Excel sheets.

Since the cash flow date is mandatory for all input, the information sources have been defaulted to use transaction level writeback. This means the user will typically design a report on a higher level but write back on a more detailed level including the cash flow date.

As mentioned above there are two information sources available for cash plan

adjustments. One of them connected to the detailed table and one connected to

the summarized table. Regardless of which information source that is used for

writeback, the adjustments written back will be reflected in both detailed and

summarized tables. This means all mandatory dimensions on detailed level also

need to be defined on summarized level regardless of the summary parameter settings

on the plan. When working exclusively with cash flow information in the

report, dimensions such as Cash Plan Company, Cash flow Date and Cash Plan

Counterpart should be used. When using the cash plan information sources in

combination with other information sources more generic dimensions such as

Company, Payment Date, Supplier and Customer can be used.