Cost Calculation

The system's cost calculation considers only the costs represented by its cost buckets. Using the cost buckets' activities or cost elements, the cost calculation algorithm finds the cost data to use when calculating costs for a part.

Aspects of Part Cost Calculation

The following aspects of a part and its structure are considered;

Standard Lot Size

The standard lot size is defined in the inventory part register, and is used to split the batch costs found in the cost calculation. The batch costs affected by standard lot size are labor setup, machine setup, subcontracting batch cost, fixed costs, user defined machine costs, labor costs, subcontracting costs and additional cost amount (purchase costing). If the factor unit is equal with the hour, labor and machine run factor will also be affected in the batch cost. The standard lot size is calculated as batch cost/standard lot size. Standard lot size also has an impact on component scrap.

Scrap Factor (%), Inventory Part

The scrap factor(%) is defined in the inventory part register, and is used when the system calculates the contribution of a component part to its parent part. The cost of a part with a defined scrap factor(%) is C x Q x (1/(1- Scrap factor(%))), where C = cost per unit and Q = quantity per assembly. Note that the inventory scrap factor (%) is not used if the part is a top level part.

Scrap Factor, Structure

The scrap factor is handled exactly as the inventory scrap factor is handled. The scrap factor is defined for a product structure. Mathematically, the scrap factor is expressed as C x Q x (1/1- Scrap Factor(Structure)), where C = cost per unit and Q = quantity per assembly. If both scrap factor(structure) and scrap factor(%) are used, they are expressed as C x Q x (1/(1- Scrap Factor(Structure))) x (1/(1- Scrap Factor(%))), where C = cost per unit and Q = quantity per assembly.

Component Scrap, Structure

The component scrap is a fixed amount of parts considered as scrap, and added to the cost calculation when the contribution of the cost to the parent part is calculated. This involves the same set of rules as in the case of inventory part scrap factor(%) and structure scrap factor. The component scrap is defined for a product structure, and is always affected by the standard lot size. The effect of component scrap on the cost contribution to a parent part is expressed as C x (Q + (Component scrap/Standard lot size)), where C = cost per unit and Q = quantity per assembly.

If inventory part scrap factor(%) and structure scrap factor are used with component scrap, the mathematical expression is C x (Q x (1/(1- scrap factor(structure))) x (1/(1- Scrap factor(%))) + (Component scrap/Standard lot size)), where C = cost per unit and Q = quantity per assembly.

Charged and Non-Charged Information

The charged information is defined within a product structure, and concerns only purchased parts. A component can either be charged or not charged. When a component to a purchased part is charged, the cost from this component is disregarded in the cost calculation.

Resource Share

When the work center cost is calculated, the cost always considers the resource share. If the routing operation has a resource share per unit defined this value will be multiplied with the standard lot size to calculate the resource share used in the cost calculation.

Labor Crew Size

When the labor class cost is calculated, the cost always considers the crew size. The crew size is defined when routings are registered. The crew size considers both labor setup time and labor runtime.

Phantom Parts

The following planning methods are managed specially within the cost calculation;

| Planning Method | Cost Calculation Aspects |

| O - Master schedule level 0 part | Not considered in the Cost Calculation. |

| T - Master schedule level 0 phantom part | Not considered in the Cost Calculation. |

| K- Blow through planning, inventory quantity onhand is not allowed. | Level cost is not calculated, but the K-part carries accumulated cost from lower levels and transfer it to parent level. |

| P- Phantom part planning, inventory quantity onhand is allowed. | Level cost is calculated, but the level cost is not rolled up to parent level. The P-part carries accumulated cost from lower levels and transfer it to parent level. |

Part Routings Cost

During the cost calculation the system tries to calculate machine and labor cost for both manufactured and purchased parts, but it only considers Manufacturing routing type. The calculation of Costed Routings is not dependent on Cost Template settings. The routing-related costs in Costed Routings are used when calculating manufacturing bucket level cost.

Inter-Site Material Costs

If the part is connected to a Cost Template that is connected to Cost Element ID 510, Inter-site Material Cost, and the part is defined as Multi-site Planned Part in Supplier for Purchase Part/General, then the system calculates Inter Site Material Cost using Supplier Site and system setup from the Costing Basic Data/Multi-Site Costing Rule tab. The result is logged in the Planned Purchase Costs page. Costs are converted to the currency code of the demand site. If supplier split is used then a weighted average is calculated.

Planned Purchase Costs

If the part is connected to a Cost Template that is connected to Cost Element ID 140, 160 or 170, then the system calculates Unit Cost, Additional Cost and Planned Charge and logs the result in the Planned Purchase Costs page. Costs are converted to the currency code of the demand site. Supplier split is considered. If supplier split is used then a weighted average is calculated.

Manufactured/Acquired Split

When Manufactured / Acquired Split is enabled and defined in the Inventory Part/Planning Data tab, the cost calculation considers the manufactured/acquired percentage split. The following example explains the concept. If a manufactured part is both manufactured and purchased on the same site and manufactured/acquired split percentages have been entered, the cost calculation will multiply cost like this:

The Connected Cost Template Consists of Both Manufacturing and External Acquired Cost Buckets

- Manufacturing level cost x Manufactured split percentage factor.

- Purchase level cost x Acquired split percentage factor.

- Accumulated cost from components x Manufactured split percentage factor.

The Connected Cost Template Consists of Only Manufacturing Cost Buckets

- Manufacturing level cost x 1.

- Accumulated cost from components x Manufactured split percentage factor.

Rules for Part Cost Calculation Using Overhead Costs

There are two types of overhead costs supported by the system; system defined overhead and user defined overhead. The base cost for a system defined overhead cost is always set within its system origin. The user defined overhead costs can be defined either as a percentage cost of a given source element, or as a fixed cost.

System-Generated Machine Overhead

There are two system defined machine overhead costs; machine overhead 1 and machine overhead 2. It is important to distinguish between the system defined machine overhead costs and the user defined machine overhead costs. The system generated machine overhead is defined on the work center, whereas the user defined machine overhead is assigned an overhead type to indicate whether it is machine overhead 1 or 2. The user defined machine overhead can be a fixed cost.

You can set both of the machine overhead cost definitions to be driven by machine hours, or by quantity. When the system uses machine hours as the cost driver, the costs are calculated in the following manner: Machine overhead cost = C x ((MSh/Standard lot size) + MRh), where C = Cost defined for overhead 1 or 2, MSh = Machine setup hours, and MRh = Machine runtime hours. When quantity is used as the cost driver, the costs are calculated as the cost defined in the work center for machine overhead 1 or 2 multiplied by the quantity.

User-Defined Machine Overhead

The user defined machine overhead is defined as a fixed cost per operation, or as a percentage of a source. If the overhead is defined as fixed, it is regarded as fixed for the operation. Regardless of how many units or number of reports on the operations are made, the cost is only attributed once. The user defined machine overhead can be set to a factor of another cost element. Whenever a cost for the underlying source element is triggered, costs are also triggered for the overhead element. The valid source elements for machine overhead are 310, 320, 321, and 322.

Note: The user defined machine overhead does not use the overhead cost definitions from the work center; it uses either a fixed cost, or a percentage of a given source element.

System-Generated Labor Overhead Cost

The system can define labor overhead costs. The cost driver of a system generated labor class can be hour or percentage. The hours definition will be the same as those of machine overhead 1 and 2. The labor overhead cost can be defined as a percentage of the labor class cost per hour.

User-Defined Labor Overhead Cost

The principles for user defined labor overhead costs are the same as those of machine overhead costs 1 and 2. They can be either a fixed cost per operation, or a percentage of a labor related source element. The valid source elements for labor overhead are 210, 220, and 221.

System-Generated Subcontracting Overhead Cost

The system can define subcontracting overhead costs. When you define subcontracting costs, you can set either the unit overhead cost, or the batch overhead cost. You can then define a percentage of the unit cost, or the batch cost respectively. These costs are absorbed in the cost calculation. If both unit overhead cost and batch overhead cost have a percentage set, both overhead costs will be used in the cost calculation.

User-Defined General Overhead Cost

The general overhead cost can only be defined as a fixed cost that is affected by the standard lot size. The general overhead has its own posting type within accounting, and is triggered once per shop order when the shop order's status changes to Started. The principle behind general overhead cost is to enable the representation of a general cost associated with a part, e.g., administrative order handling costs. The cost calculation for general overhead cost is General overhead = General fixed cost/Standard lot size.

User-Defined Delivery Overhead Cost

The delivery overhead cost is an overhead cost representing the cost of handling the received goods. This does not include costs such as freight. The delivery overhead can be defined either as a fixed cost, affected by the standard lot size, or as a percentage of the material cost. The valid source elements for delivery overhead are 110, 120, and 130.

For consignment parts, delivery overhead is posted each time the goods are consumed. However, fixed delivery overhead should be posted only once: when the goods are received. To prevent errors, the system does not allow you to use fixed delivery overhead for consignment parts.

When you use batch to calculate delivery overhead, the standard lot size is always used to calculate unit cost. The standard lot size is entered on the Inventory Part/Planning Data tab. If you purchase another volume (cost/unit) than the one that is calculated based on standard lot size, variances will result.

User-Defined Material Overhead Cost

The material overhead cost can be defined either as a fixed cost or as a percentage. The material overhead defined for a part does not affect that part, but does affect the part above it. This means that the material overhead is only used in cost calculation when the part for which it has been defined is a component to a parent part. Material overhead is used when the system issues material for a shop order. The material overhead cost is a cost associated with delivering the material from inventory onto the shop floor. If material overhead cost is defined as a fixed cost, it does not consider the quantity per assembly. It is regarded as fixed for the bundle of parts to be issued.

The material overhead cost can also be defined as a percentage of the material cost, or the total cost of the underlying part. This is unique to the material cost; since the cost is not added to the part for which it is defined, there is no problem in using the total cost as the underlying source element.

Calculate Cost for Cost Set

When material overheads are defined in part overheads, material overheads are added to the parent level in the cost structure. When material and general overheads are connected to a part, and the part cost record for the cost set has a cost template which consist of cost buckets that are connected to a cost element which uses cost element source 501 or 502, during cost calculations for a site or part or cost set, the system fetches cost using different overhead units as follows:

- Percentage of part cost - Same as for the cost element 500 (total cost). When it comes to general overhead, the rate has to be applied to the part cost excluding the earlier applied general overheads.

- Fixed value per unit - Add that cost to part cost structure.

- Fixed value per order/batch - If the overhead type is Material Overhead, then the parent lot size is used. If parent standard size is 0, then count with order size 1. To calculate unit cost, divide the fixed value with parent standard order size.

- Fixed value per weight unit - The net weight of the inventory part must be considered. Multiply the entered cost with the net weight of the part and add that cost to the part cost structure.

If sales overheads are connected to a part, and the part cost record for the cost set has a cost template which consists of cost buckets that are connected to cost elements which uses cost element source 601, during cost calculations for a site or part or cost set, the system fetches costs using different overhead units. This is similar to how the system fetches costs for Part Connected Material Overheads. However sales overheads connected to components are not inherited to parent parts and only those connected to parent parts are listed in part cost structure for the parent part. To view the sales overheads in part cost structure, Including Sales OH setting under Cost Build-Up Level in Part page needs to be selected.

When delivery overheads are connected to a part, and the part cost record for the cost set has a cost template which consist of cost buckets that are connected to cost elements which use cost element source 141, during cost calculations for a site or part or cost set, the system fetches costs using different overhead units as follows:

- Percentage of Cost Set Estimated Material Cost - The entered percentage from cost set estimated material cost of the part is added to part cost structure.

- Fixed value per unit - Add that cost to part cost structure.

- Fixed value per Order/Batch - For cost calculation, standard lot size is used. If standard size is 0, then count with order size 1. To calculate unit cost, divide the fixed value with standard order size.

- Fixed value per weight unit - The net weight of the inventory part must be considered. Multiply the entered cost with the net weight of the part and add that cost to the part cost structure.

- Percentage of Planned Purchase Price - Add the entered percentage of planned purchase price in IFS currency format as entered in supplier for purchase part of the inventory part, if planned purchase price in supplier for purchase part is 0, cost set estimated material cost of the inventory part for the cost set will be considered as the planned purchase price. (This overhead unit will not be available for Purchase Part Delivery Overheads)

- Percentage of Latest Purchase Price - Add the entered percentage of latest purchase price in inventory part, if latest purchase price is 0, cost set estimated material cost of the inventory part for the cost set will be considered as the planned purchase price.

- Percentage of Average Purchase Price - Add the entered percentage of average purchase price in inventory part, if average purchase price is 0, cost set estimated material cost of the inventory part for the cost set will be considered as the planned purchase price.

Calculation of Lead-Time Cost

The lead time cost is calculated by using the level lead time of any given manufactured part and the cost and quantity per assembly. The latter calculation must be done for every part in the structure, regardless of whether the part is manufactured or purchased. Level lead time is only relevant in the case of the manufactured part. The purchased part is considered as a cost, together with the manufactured part in the next level of the structure. The part with the longest lead time sets the pace for the other parts on that level.

Example of Lead-Time Calculation

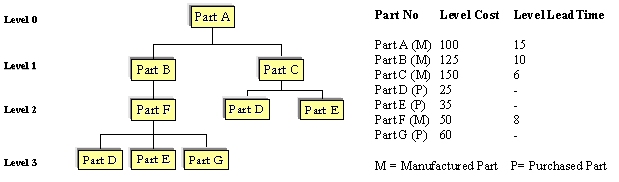

The following illustration explains lead time calculation of manufactured part A with the following structure and costs.

Figure 1 - Manufacturing structure of part A.

- The calculation starts with the lowest level of the part. Level three holds parts D, E, and G, all of which are purchased parts which do not affect lead time calculations. The costs from parts D, E, and G should be combined with the costs from part F (25+35+60+50); this should be the cost starting from day 1 to day 8, the lead time of part F.

- Since part B has a longer lead time than part C, the cost of part B is added to the accumulated costs before adding costs for part C ((25+35+60+50)+125 = 295).

- The cost of part C is added when four days have passed. A generalization is that the cost of a manufactured part on the same level as other manufactured parts is added to the total cost when the number of days passed equals the maximum lead time of a manufactured part at the same level minus the lead time of the part in question. In this case, the cost of part C is added after four days; max lead time - lead time of C = 10-6=4. Part C carries the cost of the purchased parts from the former level.

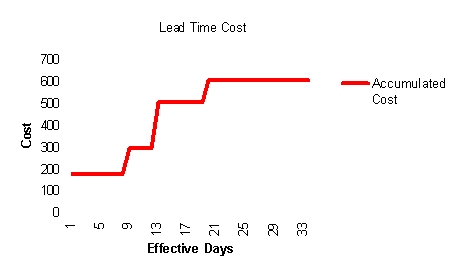

The following illustrates the result from the above calculation:

Figure 2 - The result of a lead time cost calculation of part A.