Disassembly Cost Calculation

In circular processes like refurbishing and remanufacturing, a used product

is normally the initial object. The first step in the process is then to disassemble

this product into components. By disassembling, refurbishing and reusing components,

similar products can be built to a significantly lower cost and less environmental

impact

It is important to be able to calculate standard cost for these disassembled

components. The calculation is done by distributing all material and disassembly

operation costs for a product to all the components that can be expected to

be reused.

Disassembly Component Standard Cost

The disassembly component is a part that is being produced by disassembling another part, normally a used product e.g. a scrapped engine.

A disassembly component is identified by a specific inventory part type, Disassembly Component.

Standard Cost for a disassembly component can be calculated based on the

cost for the part that is being disassembled and the cost for the operations

needed for the disassembly process. Sometimes additional components are needed

to perform the process and then the cost for those must be included. This is

a significant difference from the normal manufacturing cost calculation where

the cost is accumulated from all its components and operations. In the disassembly

case the cost is instead distributed to multiple components that come out from

the process.

Disassembly Standard Cost calculation requires the following data to be correctly set up.

Disassembly Structure

A product structure of type Disassembly must exist, valid for the effective date with a * alternate in status Plannable or Buildable. Components that come out from the process are registered in the Produced Parts tab in Product Structure page. Additional components needed for the process are registered in the Components tab.

For each disassembly component following parameters can be registered that controls the cost calculation.

Operation Cost Distribution Factor

This factor controls how much of the total operation costs that will be distributed to a certain component.

General Overhead Distribution Factor

If general overhead is used this factor controls how much of the general overhead costs that will be distributed to a certain component.

Scrap Factor

The scrap factor defines, for each disassembled component, to which extent that part is expected to not be possible to reuse. Expected scrap will increase the cost for a component according to a factor 1/(1 - Scrap Factor).

Cost Distribution

In Component Cost Distribution tab the Cost Distribution factor is defined for each disassembled component. The cost for input components can be distributed individually so the cost for the disassembled part is distributed in one way and other additional components are distributed in another way.

Disassembly Routing

A product routing of type Disassembly must exist, valid for the effective date with a * alternate in status Plannable or Buildable.

For each operation following parameters can be registered that controls the cost calculation.

Operation Quantity Factor

The operation costs are calculated same way as for a manufactured part with the addition of the operation quantity factor set for each operation line. This parameter is used by the disassembly process. The Operation Qty Factor field indicates how big share of the total order quantity that normally pass this specific operation, e.g. a cleaning operation that is sometimes needed and sometimes not.

Other cost impacting data

Other part related data will impact cost calculation in the same way as in traditional cost calculation, i.e. it will build up cost for the parent part which is then distributed to the disassembly components. This data includes: Standard lot size and Scrap Factor (%) for Inventory Part, Scrap Factor (%) and Component Scrap for Product Structure. It also includes Delivery Overhead, Material Overhead and General Overhead.

For further information about part cost calculation see more in About Part Cost Calculation.

Cost Templates

Dissassembly Components

The disassembly cost calculation is based on the parts that are being disassembled. This means that cost is calculated for the top part and pushed to the components rather than calculated at component level and fetched from the parent. This also means that the content of cost buckets in the cost template for the disassembled components is of less importance since the components will inherit the buckets from the parent.

An exception from this is when disassembly is performed in two steps. The cost template then also need to pick up operation costs for the second level disassembly.

It is important that the disassembled components have a cost template with the toggle switch Use Cost Distribution enabled. Otherwise, it will calculate using normal part cost calculation. This set up can be used for a manually added cost for the disassembly component which would then be entered as an estimated part cost for the component.

A standard cost template D-110 is created when registering a new site. It is the default cost template for new inventory parts with part type Disassembled Component. This template has Use Cost Distribution set and contains the standard manufacturing cost buckets. If estimated cost should be used, the cost template must contain a bucket for estimated cost, e.g. standard Cost Template P-110 can be used.

Disassembled Part

For the part that is being disassembled the cost template serves two purposes

- Control the cost calculation for the part itself.

- Control the cost calculation for disassembling the part.

Typically, the disassembly parts will be purchased and therefore need an

externally acquired cost bucket, e.g. 110. It is also important that the Cost

Rollup Control flags Use External Acquired Costs is

enabled and Use Manufacturing Costs is disabled.

In order to pick up the operation costs for disassembly, the manufacturing

cost buckets need to be included. These will be used by the disassembly cost

calculation if Use Manufacturing Costs is disabled.

An easy way to create this cost template is to copy the M-110 template, add a procurement bucket (110, 120, 130 or 140) and switch the cost rollup from Use Manufacturing Costs to Use External Acquired Costs.

Produced Part Cost Base

A certain disassembled component could sometimes originate from various parents. However, the calculated cost will always only originate from one parent. In case there exist more than one you need to select which one to use for the calculation. This is done in the Produced Part Cost Base tab, in Part Cost page. This tab lists all possible parents based on existing plannable or buildable Produced Part structures. Note! This tab also point to which material line to use for calculation, which means that in case same part exists on multiple lines in a structure, cost will only be based on the selected line.

Calculation

The disassembly cost calculation is performed by Disassembly Cost Calculation. Before calculation of disassembly cost it is important that the cost for the disassembled products and input components are correctly calculated. This means that a traditional cost calculation should be performed prior to the disassembly cost calculation.

The disassembly cost calculation will look for any part, according to the selection criteria, that has a valid (buildable or plannable) disassembly structure on the effective date. For each structure found, the calculation will be performed in a top-down manner. This means the cost for the parent and other components plus operation costs according to the routing plus defined overheads according to the parent’s cost template will be distributed to the disassembled components according to the distribution factors. Only components that have a cost template with Use Distribution Cost set will be updated.

If any of the disassembly components, that get their cost updated according to above, has its own valid disassembly structure the calculation will continue with the newly updated cost as input.

Examples

Example 1

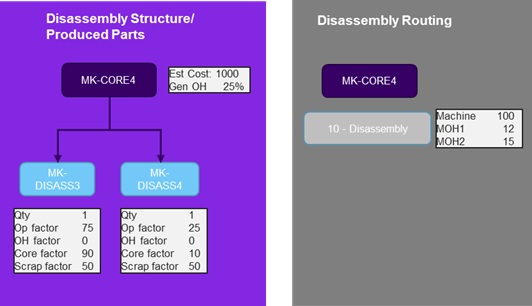

In this example the parent MK-CORE4 is disassembled and each MK-CORE4 gives one MK-DISASS3 and one MK-DISASS4. However, in 50% of the cases those will not be possible to reuse so the scrap factors are set to 50%

The disassembly process is performed in one operation with just a machine time of 1h and the work center cost 100/h with OH1 of 12 per unit and 15 per batch.

Costs are distributed differently for material and operations according to factors below.

Picture 1 - Disassembly example 1, set up

The resulting cost for the disassembled components will then be:

(Material cost*Mtrl factor)+(operation cost*Op factor)/(1-Scrap factor)

Tot cost MK-DISASS3 = (1000*0.90+(100+12+15)*0.75) / (1-0.5) = 1990.5

Tot cost MK-DISASS4 = (1000*0.10+(100+12+15)*0.25) / (1-0.5) = 263.5

Assuming a template with standard manufacturing cost buckets (E.g. copied from M-110) is used for MK-CORE4 this cost is distributed to cost buckets according to the table below.

| Bucket | MK-DISSASS3 | MK-DISASS4 |

| 110 - Estimated Material Cost | 1800 | 200 |

| 300 - Machine Cost | 150 | 50 |

| 321 - Machine Overhead1 Cost | 18 | 6 |

| 322 - Machine Overhead2 Cost | 22.50 | 7.50 |

Table 1 - Disassembly example 1, resulting costs

Example 2

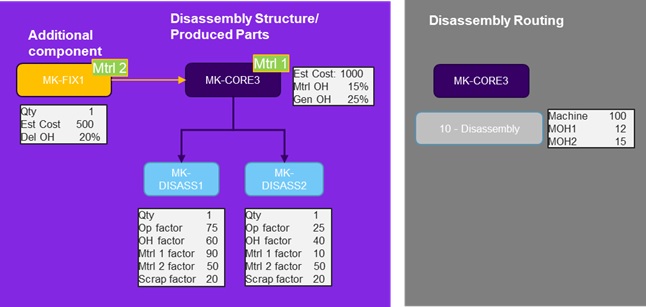

This example is similar to the previous, but it has an additional component, MK-FIX1, needed for the disassembly process. Also, delivery, material and general overheads are added.

Picture 2 - Disassembly example 2, set up

Resulting costs for each disassembled component will be calculated according to:

Estimated cost = ((Mtrl1 Est Cost * Mtrl1 factor) + (Mtrl2 Est Cost * Mtrl2

factor)) / (1 - Scrap factor)

Delivery OH = (Mtrl2 Est Cost * Mtrl2 Del OH

* Mtrl2 factor) / (1 - Scrap factor)

Machine cost = (Machine Cost * Op factor)

/ (1 - Scrap factor)

Machine OH1 = (MOH1 * Op factor) / (1 - Scrap factor)

Machine OH2 = (MOH2 * Op factor) / (1 - Scrap factor)

Mtrl OH = (Mtrl1 Est

Cost * Mtrl OH * Mtrl1 factor) (1 - Scrap factor)

Gen OH = ((Mtrl1 Est Cost+

Mtrl2 Est Cost+ Mtrl2 Est Cost * Mtrl2 Del OH + Machine Cost+

MOH1+ MOH2+

Mtrl1 Est Cost * Mtrl OH) * OH factor) / (1 - Scrap factor)

Assuming a template with standard manufacturing cost buckets (E.g. copied from M-110) is used for MK-CORE4 this cost will be distributed to cost buckets according to Table 2.

| Bucket | MK-DISSASS1 | MK-DISSASS1 |

| 110 - Estimated Material Cost | 1437.50 | 437.50 |

| DOH20 – Delivery OH 20% | 62.50 | 62.50 |

| MOH15 – Material OH 15% | 168.75 | 18.75 |

| 300 - Machine Cost | 93.75 | 31.25 |

| 321 - Machine Overhead1 Cost | 11.25 | 3.75 |

| 322 - Machine Overhead2 Cost | 14.06 | 4.69 |

| GOH25 – General OH 25% | 351.94 | 234.63 |

| Total Cost | 2139.75 | 793.06 |

Table 2 - Disassembly example 2, resulting costs