Remanufacturing Cost Calculation

In circular processes like refurbish and remanufacturing, a finished product is built, fully or partly, from disassembled reused components.

It is important to be able to calculate standard cost of a remanufactured product. Such products are characterized by being assembled from a mix of new and reused components, based on pre-defined remanufacturing structures and routings and the expected mix must be considered in the calculation.

Remanufactured part standard cost

A remanufactured part is a part that to a significant extent is built by reused components that have been disassembled and refurbished from scrapped products, e.g. a truck engine. Remanufactured parts are defined by the inventory part type, Remanufactured. These parts also have the structure type, Remanufactured, but can also have a Manufacturing structure when they can be assembled in a normal manufacturing process. The main difference with the Remanufacturing structure type is that a primary alternate component for each material line can be defined. Each line can then define an alternate component factor which defines to what extent the alternate can be used instead of the main component.

Costing implications

Remanufactured parts are calculated in the same job as manufactured and purchased parts. Which structure and routing to be used are defined by the inventory part type. If the part type is Remanufactured the cost calculation will look for a valid Remanufacturing Structure and Remanufacturing Routing.

Operation costs are calculated the same way as a manufacturing structure with the addition of Operation Qty Factor field on the operation line. The Operation Qty Factor controls to what extent the operation is expected in the process.

Material costs will use the cost from both the main component and the primary

alternate component on each material line. The cost for the line will be a weighted

average between those costs where the weight is defined by the Alternate

Component Factor.

In the cost structure tree both these components

will be displayed with their adjusted quantities based on the Alternate

Component Factor.

Data set up

Remanufactured cost calculation requires the following data to be correctly set up.

Inventory Part Type

For a part to be considered by remanufacturing cost calculation, it must be defined as Remanufactured.

Alternate components

Components that are possible to change to an alternate must have this alternate defined as an Alternate Component. This alternate must also be Primary.

Remanufacturing Structure

A product structure of type Remanufacturing must

exist, valid for the effective date with a * alternate in status Plannable or

Buildable.

For each line where a primary alternate exists, Alternate

Component Factor must be defined.

Remanufacturing Routing

A product routing of type Remanufacturing must exist, valid for the effective date with a * alternate in status Plannable or Buildable.

Operations

Operation Qty Factor

This field indicates how big share of the total order quantity that is typically supposed to pass this specific operation, e.g. a cleaning operation that is sometimes needed and sometimes not.

Other cost impaction data

Other part related data will impact cost calculation in the same way as in traditional cost calculation. This data includes: Standard lot size and Scrap Factor (%) for Inventory Part, Scrap Factor (%) and Component Scrap for Product Structure. It also includes Delivery Overhead, Material Overhead and General Overhead.

For further information about part cost calculation see more in About Part Cost Calculation.

Cost Template

Remanufactured parts will per default be assigned to the Manufacturing Cost

Template defined for each Cost Set.

It is important that the cost template

used has the Use Manufacturing Costs toggle set.

Calculation

The Remanufacturing cost calculation is performed in the normal Part Cost Calculation. Calculation of remanufacturing cost require that the costs for alternate components with a disassembly component template (Use Cost Distribution = TRUE) are already calculated, as the disassembly cost calculation is not part of the remanufacturing calculation.

Examples

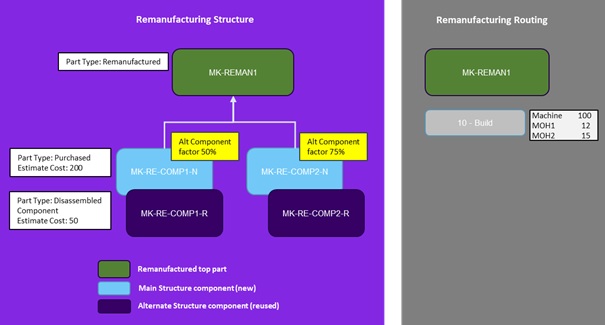

In this example a remanufactured part is assembled from two component using one operation. Each of the components could either be a purchased item or a disassembled component from a disassembly process. The alternate component factor indicates to which extent the disassembled component is used. This factor is used for all existing cost buckets in the cost roll-up.

Assuming the new components will both have only an estimated material cost of 200 and the disassembled alternates will have an estimated cost of 50 the resulting cost for the top part will be as in Picture 1.

Picture 1 - Remanufacturing example, set up

Machine Cost + MOH1 + MOH2 + Estimated Cost MK-RE-COMP1-N * 0,5 + Estimated

Cost MK-RE-COMP1-R * 0,5 + Estimated Cost MK-RE-COMP2-N * 0,75 + Estimated Cost

MK-RE-COMP1-R * 0,25

100+12+15+200*0,5+50*0,5+200*(1-0,75)+50*0,75=339,5

Costs will be calculated per cost bucket with result as in Table 1.

| Bucket | MK-REMAN1 |

| 110 - Estimated Material Cost | 212.5 |

| 300 - Machine Cost | 100 |

| 321 - Machine Overhead1 Cost | 12 |

| 322 - Machine Overhead2 Cost | 15 |

| Total Cost | 339.5 |

Table 1 - Remanufacturing example, resulting costs