IFS Trip Tracker makes it easy to track expenses, mileage, and deductions during your travels. The completed travel report can then be sent to IFS Applications as an expense sheet for further processing and reimbursement.

IFS Trip Tracker is centred around an itinerary, making it easy to do all your reporting while you are travelling and having the “paperwork” done by the time you return.

In its current version, IFS Trip Tracker handles expenses, mileage, allowances and deductions for domestic as well as international travel. Organizations can choose whether to allow reporting against multiple companies or against the user's default company only. IFS Trip Tracker also supports both “one report per trip” as well as “periodic expense reporting” styles of trip/expense claims.

IFS Trip Tracker can be used in Try Me mode with demo data without requiring a log on or network connection.

To use IFS Trip Tracker connected to your company’s IFS Applications installation(s) you must be a user of IFS Applications, and your company must have a valid Touch Apps Server Connectivity installed.

Redirect URI for IFS Trip Tracker are

Please refer Authentication configurations for the exact steps that must be followed to setup the redirect URI on the identity provider that is being used in your system.

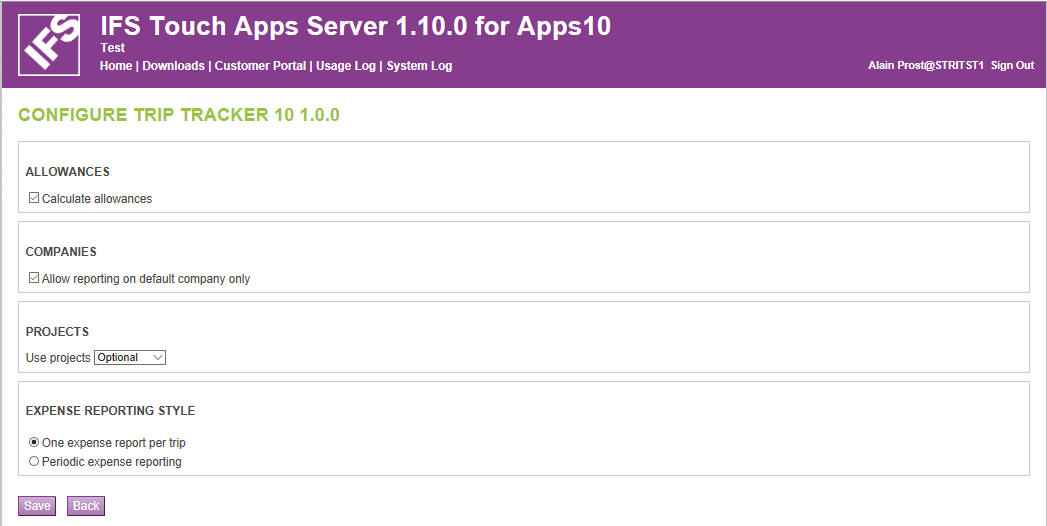

IFS Trip Tracker has a set of configuration settings that can be changed by logging into the IFS Touch Apps Server, Customer Portal. These will be necessary for altering how the app behaves. It currently includes the following options.

Calculate Allowances – Yes/No

Uncheck the “Calculate allowances” option to disable the use of allowances from within the app even if IFS Travel Allowance module is installed and granted to the user. If allowances are disabled you are not allowed to add Deductions and Benefits to a trip.

Allow reporting on default company only – Yes/No

Only allows you to enter values for Company field if this is set to yes. Otherwise your default company will be used automatically whenever it is required (such as when creating a new trip).

Use projects – Mandatory/Optional/Not Used

If this setting is set to Mandatory or Optional, the user can specify Project Activities when creating a trip or adding mileages/expenses. Having this setting as Mandatory requires you to always provide the project activity details.

Expense reporting style - One expense report per trip/Periodic expense reporting

This option decides whether expense reporting should be done with one report

for each trip or with periodic (for example weekly, monthly) expense reporting.

With periodic trip reporting users should set the trip start date to the start

of the reporting period, and the trip end date to the end of the reporting

period. With this option it also becomes possible to have “wholes” in the date

series for a trip. Another important difference is that with periodic expense

reporting it is not possible to use the travel allowance functionality.

Deductions & Benefits cannot be added if this setting is Periodic expense

reporting.

In order to report expenses, you need to start a new Trip from the app. This requires you to enter a few basic information describing the trip. The details that need to be provided are listed below. Note that some of these fields may be hidden according to the configurations settings mentioned previously.

Specify the company that you would like to report expenses against. It will show a list of all companies that you are allowed to report to. If the default company is forced by how the app is configured, then this field will be hidden as it automatically applies the default company value for the entire trip.

A short description about the Trip. This will also be shown in the expense sheet that will be created when the trip is sent to IFS Applications.

Currently, there are 4 types of Trips that you can report expenses on. Namely Domestic, International, Mileage-only and Expense-only. However, if Periodic expense reporting is used as per the configuration, you will not be able to select the trip type since it uses its own fixed trip type. The types of items that you can add to a trip depends on the type of the trip. See section “Reporting items for an ongoing trip” for more information.

Selecting these values is only allowed when the Use Projects configuration settings is set to either Optional or Mandatory. In the case of Mandatory, it is compulsory to select a project and project activity but you can leave the field blank if it’s set to Optional. Apps on certain platforms allow you to individually select through Projects, Sub Projects and then Activities but some may allow only selecting the Activity directly. If projects are not used in your organization, this field will not also be used.

The date and time when the trip had started on.

Any additional information or a description that you would like to add to the expense sheet.

If reporting against projects are allowed, you can specify which projects and sub projects that needs to be displayed when creating a new trip or adding items to a trip. By default, Trip Tracker will show a list of your most recently used projects in IFS Applications even if it’s the first time you’re using the app.

Apart from these, Trip Tracker allows you to search for projects using the project ID and save them as shortcuts so that it’s easier to report using them. You can also save them with a display name to help identify them better or delete them if they are not being used anymore. The projects search functionality can be accessed from the menu option found in most Trip Tracker apps.

Once a new trip has been created, you can add days to report items on. Typically, the first day will be automatically created. If you need additional days, they can be added sequentially. Note that only consecutive days can be added and gaps between days are not allowed. Only the last day of the trip can be removed provided that it has no items reported.

Trip items are added for a particular day. The types of items that can be added depends on the trip type. Once items are added, they can optionally be edited or deleted. See below for a list of items that can be added for each type of trip.

| Trip Type | Applicable Items |

| Mileage Only | Mileage |

| Expense Only | Expense/Receipt |

| Domestic | Mileage, Expense/Receipt, Deductions & Benefits* |

| International | Mileage, Expense/Receipt, Deductions & Benefits*, Travel Events |

* Only one Deductions & Benefits item can be added per day

Added as mileage items in the expense sheet. The following information can be provided when adding a new mileage item.

If you want to split the costs across various project activities or split the mileage onto different dates, you must enter each item separately using those details.

Added as employee expenses in the expense sheet. The following information can be provided when adding a new expense or receipt.

Same as for mileage items, if you need to split costs across various project activities for expenses, you need to enter separate Expense/Receipt items for those.

Allows you to state meal deductions and own accommodations. Select the required items for the compensations that you need to record. A trip day can have only one Deductions & Benefits item and you can change it later or remove it as long as the trip is still in progress. Given below are the options that are provided.

Deductions & Benefits cannot be added to a trip if Periodic expense reporting setting is used.

Entering your route information by means of travel events allows correct registration of abroad allowances in IFS Applications. Travel events are only permitted for International Trips. You can add travel events to any day of the ongoing trip.

Travel events can be added sequentially to indicate the route of your travels. For this, you may add two or more travel events as the minimum and they have to be in pairs. If calculation of allowances is enforced depending on how the app is configured, it is mandatory to add travel events to an international trip. A trip must always end in the home area.

Once you have created a new trip, you can always go back and edit its details. This commonly include changing the purpose or the project connections for a trip. The trip type can also be changed after it has been created, but there are some restrictions that apply here. You can only make trip types change as stated in the below table.

| Current Trip Type | New Trip Type |

| Mileage Only | Can be changed to International/Domestic |

| Expense Only | Can be changed to International/Domestic |

| Domestic | Can be changed to International |

| International | No changes allowed |

When a trip needs to be concluded, you can navigate to the End Trip action from the app. This will show a summary of all the items added to the trip and other relevant details. If there is a problem with the items added or the data entered, it will be shown so that you can resolve the issue.

You can set the date that the trip has ended and select one of the two available actions.

Make sure the end date is set to a date after the start date and past the latest date from all items added to that specific trip. In case there’s a mismatch between the dates entered, you will be notified.

Once the trip has been queued for sending, you will see the progress of it being processed. Should a trip fail due to some reason while transmitting, it will be automatically reverted and the error will be displayed. Sometimes the error may originate from the actual business flow that is happening from the IFS Applications side or otherwise a network issue that is hindering the expense sheet being sent. In the event of an error, no items related to the trip will be created in IFS Applications.

When you are informed that an error has occurred, you have the option to review the trip to change any information that you have provided. If it’s not an error related to data, then you can simply re-attempt sending (and optionally confirming) the trip again later without making any changes to the items that you have entered.

For all trips that have been sent successfully, the amount for the expense sheet and its ID will be displayed. The expense ID can be used to verify or cross-check the trip details from IFS applications.

These include the costs and other information that is used when reporting mileages or expense/receipt items. Two types of different expense codes will be used in both cases, but basically they are very similar.

An expense sheet contains all of the expenses, deductions and compensations incurred during a trip. A unique Expense ID number identifies each expense sheet. The expense sheet is always connected to one employee and one company. The expenses can be connected to different projects and activities. Prices, VAT and allowances are automatically calculated depending on how the rules are defined in the system. The employee can confirm the information when registered.

A solution provided by IFS for deploying a system similar to IFS Cloud within your organization’s own infrastructure. Customers that have licensed IFS Touch Apps server can install and provide Touch Apps services hosted in a location of their choice.

A unique identifier text which is mapped to the IFS Applications installation from the cloud. You will have to specify this while logging into a Touch App or the IFS Touch Apps Cloud Customer Portal.

This allows you to try out an IFS Touch App without the need to have a

network connection or an IFS Applications installation. This mode uses a data

set stored entirely on the device to demonstrate the functionality of the Touch

App. It will not communicate with IFS Applications nor modify any actual data

stored in it.