Analysis Models - Basic Data Configuration¶

Use this page to learn how to set up basic data in IFS Cloud to ensure that the IFS Analysis Models specific Tabular Models will work properly. It is important to point out that the basic data configuration is closely related to data configuration.

The following basic data in IFS Cloud is mandatory to make sure that most of the delivered Tabular Models work properly.

- Reporting Periods

- Reporting Currency Rate Type

Other mentioned basic data is also important but only affects specific Tabular Models.

Reporting Periods¶

Most of the Tabular Models in the IFS Analysis Models use a dimension named Company Reporting Period, related to the Reporting Period functionality in Accounting Rules. The purpose is to supply a common period definition to be used as a replacement for accounting periods especially for cross product reporting. It is also possible to use Reporting Periods on a non-company level, grouping a cross product related date into a set of periods.

For each product area covered by the Tabular Models, it is necessary to set up the Reporting Period Definition ID to be used. In IFS Cloud this means setting up the Company Reporting Period information that should apply for each and every company to be analyzed.

Delivered Tabular Models supports or will support the following product areas where the Reporting Periods are important:

- Financials

- Inventory

- Maintenance

- Manufacturing

- Procurement

- Project

- Sales

Note: If Reporting Periods are not supplied, the Tabular Models will not work properly.

Note: The dimension Company Reporting Period will in most Tabular Models be represented by the table REPORTING PERIOD. The date used as a key attribute when defining the Company Reporting Period identify in each Information Source, will also be used to define the column to be connected to the time dimension named REPORTING DATE.

The table REPORTING PERIOD when defined in several Information Sources makes it possible to combine information from different product areas into one single model, thus enhancing cross product analys possibilities.

For more details please refer to Data Configuration.

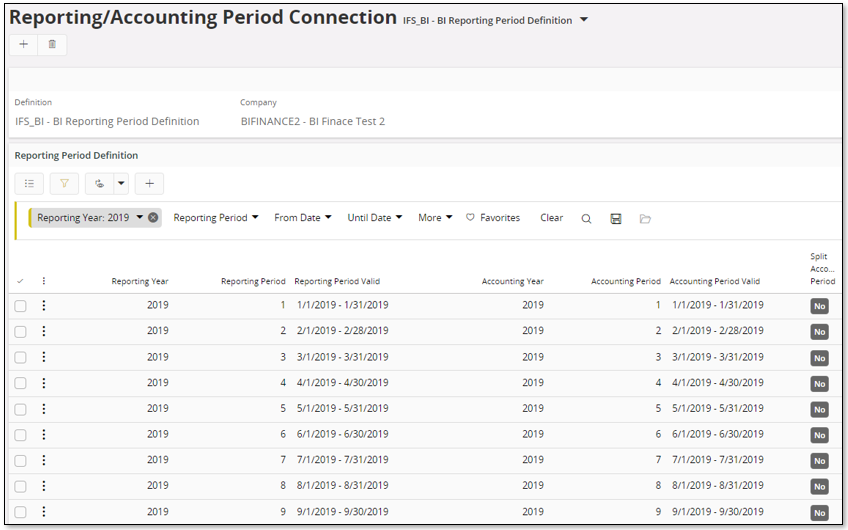

For the Financials model the following is important:

- The Fiscal Calendar may differ from the ordinary calendar and it is import to map accounting/fiscal periods correctly. Normally this is handled automatically (see functionality described below).

- To make the Financial model work properly it is also important to include Incoming Balances and Year End periods. This normally leads to that fiscal period 0 (Incoming Balances) and period 1 are part of Reporting Period 1. For a year with 12 fiscal period, Reporting Period 12 will include fiscal period 12 and year end periods.

- Another important thing to notice is that the Financial model requires that there is one company, a master company, for which the mapping between reporting periods and accounting periods is used to build a date hierarchy. All companies to be analyzed should thus have the same accounting period calendar definition and they must also share the same reporting period definition.

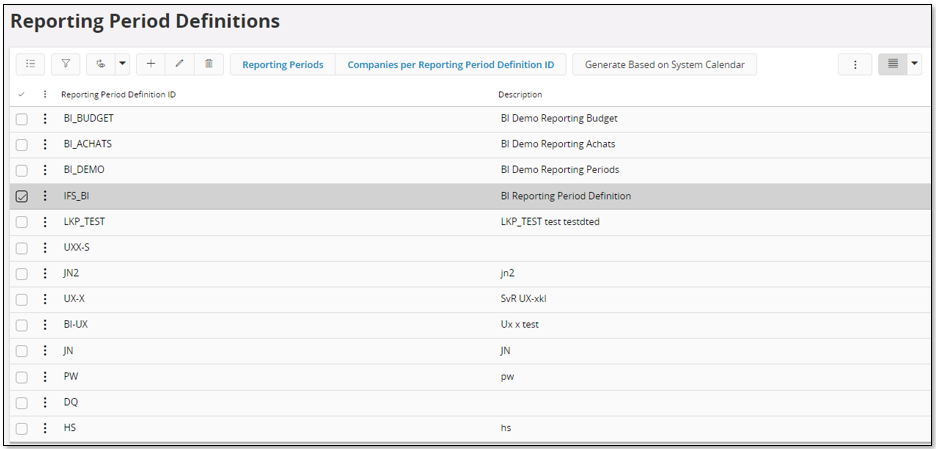

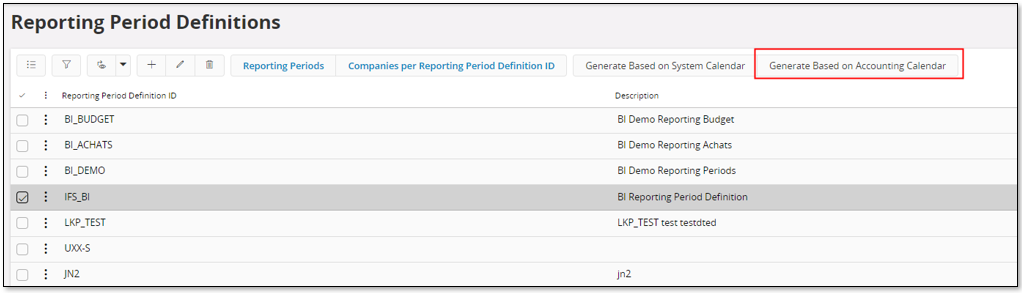

Start by defining the Reporting Period Definition IDs to be used in the Reporting Period Definitions page.

There are two ways to proceed:

- Definition the reporting periods manually and then handle mapping against Accounting Periods

- Creating the reporting periods based on the Accounting Calendar of a specific company.

Starting with the manual approach.

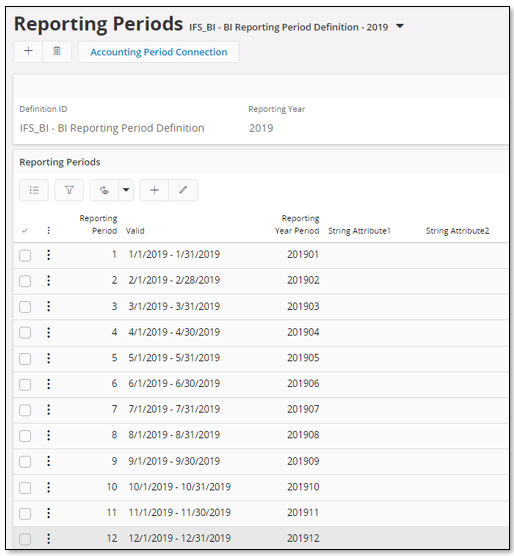

Define the reporting period details, dates per year and period, for each Report Period Definition ID. This is done in the Reporting Periods page.

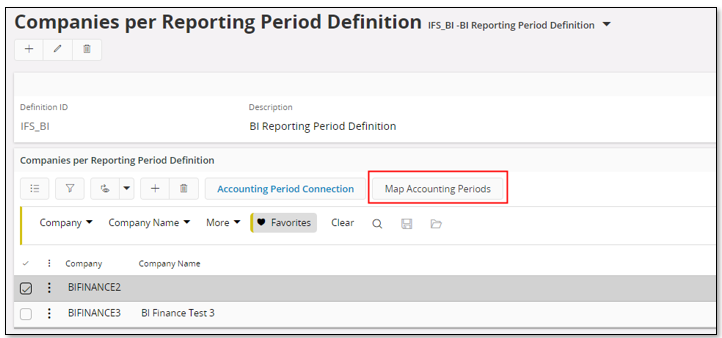

Next step will be to define all companies that should be connected to the same Reporting Period Definition ID and to map accounting periods with reporting periods.

This is handled in the Companies per Reporting Period Definition page.

It is of course also possible to modify automated mappings or to define mappings between accounting period and reporting period manually via the Accounting Period Connection page.

The second approach is to handle the creation of reporting periods automatically.

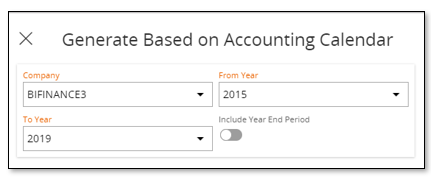

After having created the reporting period definition, select the definition and use command Generate Based on Accounting Calendar.

Select a company. This is typically the master company that will be defined in the Data Configuration. Then specify from and until accounting year and make sure to also include Year End (and Incoming Balances) periods.

The selected company will be connected to the reporting period definition and the accounting periods within the given year interval will be used to create reporting periods as well as the mapping between reporting periods and accounting periods.

Reporting Currency Rate Type¶

Most of the Tabular Models in Analysis Models support calculation of base currency amounts into a reporting currency. To make this possible it is required to define the rates to be used for the calculations. It is only possible to use one rate definition, i.e. one single combination of company and rate type must be defined as the reporting currency rate source.

Note: It is mandatory to define the Reporting Currency Rate Type to make sure that the Tabular Models work correctly.

Please also refer to Data Configuration.

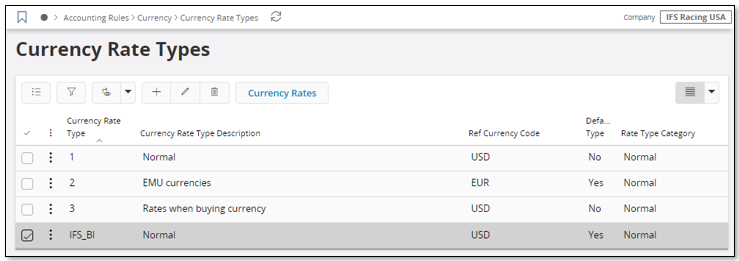

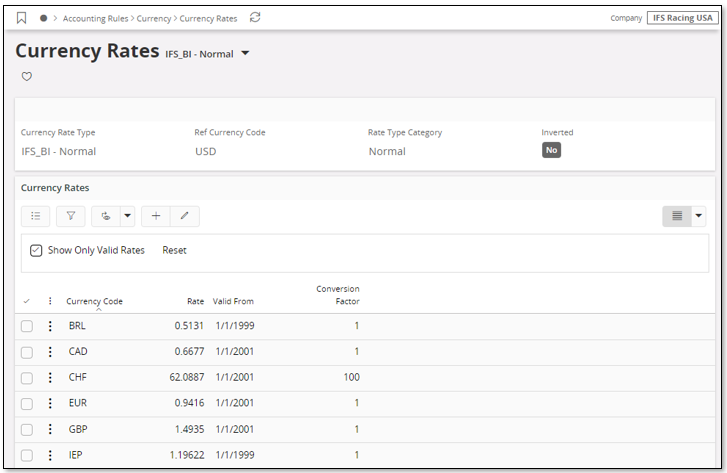

The rate type is defined for the selected source company in the Currency Rate Types page.

In the above case, the Currency Rate Type with identity IFS_BI in company 10 (IFS Racing USA) has been selected as the rate source for reporting currencies.

Details, i.e. rates per currency, are defined in the Currency Rates page.

Balance Sets¶

Tabular Models in the Financials area (General Ledger and Group Consolidation) are using information from different balance set specific Information Sources; GL Balance Set Analysis and Consolidation Period Balance Set Analysis respectively.

Note: The General Ledger model is completely based on balance set configurations, thus it is a MUST to define balance sets for all companies that should be possible to analyze using the GL tabular model. Also remember to use the same balance set identities in the selected companies since measures in the GL model can only be derived from four balance sets. For more information please refer to Balance Set Configurations for Analysis Models

For General Ledger the Information Source retrieves information from:

- GL Balances

- GL Period Budget

- Business Plan

This Information Source has a connected dimension named GL Balance Set. Balance Sets are defined on company level. The idea is to define which one of the four mentioned sources that applies to a given accounting period, opening up for rather flexible analysis possibilities.

For Group Consolidation the Information Source retrieves information from:

- Consolidated Balances

- Consolidated Reported Balances

- Consolidated Parallel Balances

This Information Source has a connected dimension named Consolidation Balance Set. It works similar to GL Balance Set.

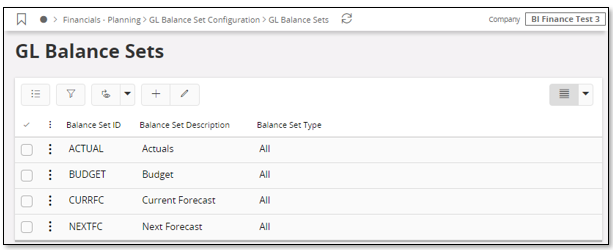

In the following section the setups for the different areas are described using GL Balance Set as an example. GL Balance Sets are defined for the current company in the GL Balance Sets page. Setup for Consolidation Balance Set works in almost the same way for Group Consolidation model. In the latter case you use the pages Consolidation Balance Sets, Consolidation Balance Set Period Configuration and Consolidation Balance Set Configuration for Analysis Models.

Note: In the case of Group Consolidation the model only contains data for one master company.

Any number of balance sets can be created. However, it is important to notice that the GL model by default only supports analysis information based on four specific GL Balance Sets, in the model recognized by the following:

| Tabular Model Balance Set Identifier | Description |

|---|---|

| ACT | Actual Values |

| BUD | Budget Values |

| CFC | Current Forecast |

| NFC | Next Forecast |

It is recommended to define GL Balance Sets for one or more of the above four alternatives to prepare for flexible GL analysis. In the above example the balance sets with identities ACTUAL, BUDGET, CURRFC and NEXTFC have been defined to represent the specific analysis sets.

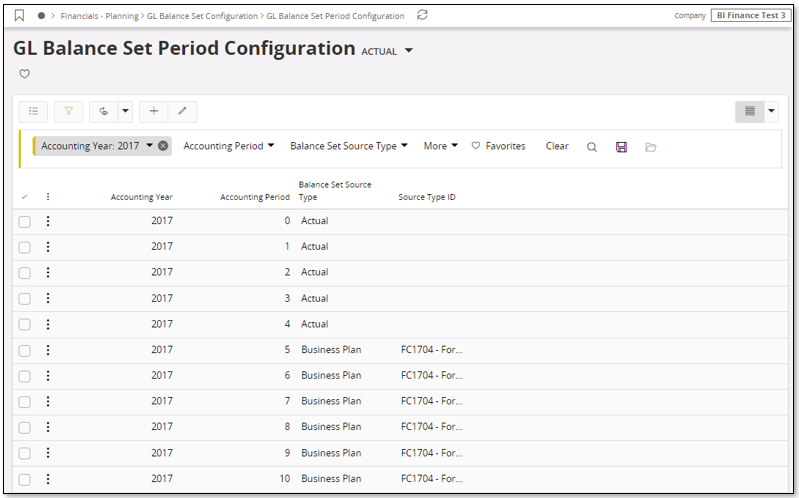

Balance sets to be configured by using the Balance Set Configuration command to open the GL Balance Set Period Configuration page.

The period configuration is done per balance set. For each period in the accounting years to be analyzed the source type is defined. The source types are:

| Source Type | Meaning |

|---|---|

| Actual | GL Balances |

| Budget Version | GL Period Budget |

| Business Plan | Business Planning Transaction - Valid Version |

For the source types Budget Version and Business Plan it is necessary to supply the source type identity, i.e. the budget version or the budget process identity or the business plan identity. One example can be seen in the above image where for the Balance Set Source Type = Business Plan a business plan is supplied as the Source Type ID.

The described functionality provides the possibility for a Financial administrator/manager to set up different analysis scenarios that can be configured rather easily and that will affect the information transferred to the SQL Server database and at the end affect the tabular model content. E.g. at the beginning of the year the actual analysis set may contain only information from GL Period Budget. When the second period is entered, the first period can be modified to represent the actual values. At the same time a budget and a current forecast analysis set can be defined, enabling analysis of actual values versus budget and current forecast over a whole year.

Balance Set Configurations for Analysis Models¶

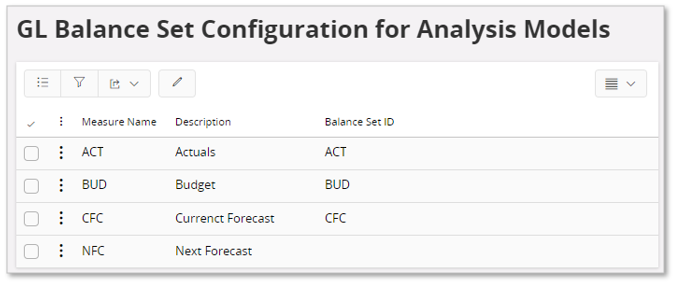

To define the GL Balance Set identities that should be used in the GL Balance model to represent the fixed measures ACT (Actual), BUD (Budget), CFC (Current Forecast) and NFC (Next Forecast) the GL Balance Set Configuration for Analysis Models page is used.

In addition to the specified GL Balance Sets above, another three measures, X1, X2, X3 exist for the Consolidation Balance Sets . Those can be used freely, for example to analyze consolidated balances using the currency rates of the previous year.

Accounting Structures¶

Models in the Financials area use Accounting Structures to in a rather flexible way be able to visualize accumulated values on structure node level.

The following is supported:

- Two structures based on Account, one representing an Income Statement structure and the other representing a Balance Sheet structure.

- One structure for each one of the code parts B to J

To analyze more than one company in the model it is required that all these companies have the same structures defined.

Accounting Structures are defined for the selected source company in the Accounting Structure page.

For more information please also refer to Data Configuration.

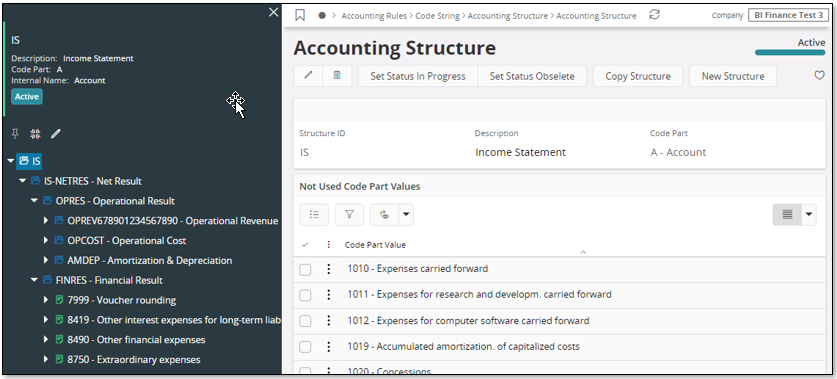

Income Statement Structure¶

The Income Statement (IS), typically defines a structure suitable for analysis of profit and loss in a company. The structure is based on Account.

Remember the following:

- The same Structure Identity must be defined in all companies to be analyzed in the Tabular Model.

- Any Structure Identity can be used. In this example it is assumed that the identity is IS.

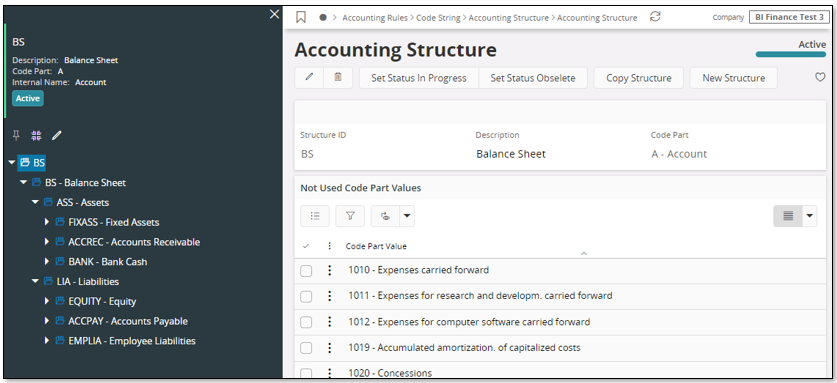

Balance Sheet Structure¶

The Balance Sheet structure is based on Account.

Remember the following:

- The same Structure Identity must be defined in all companies to be analyzed in the model

- Any Structure Identity can be used. In this example it is assumed that the identity is BS.

Structures for Code Parts B to J¶

The General Ledger model also supports structures based on code parts other than Account.

- Only one accounting structure is supported for each one of code parts B to J

- The same structure identity must be defined in all companies to be analyzed.

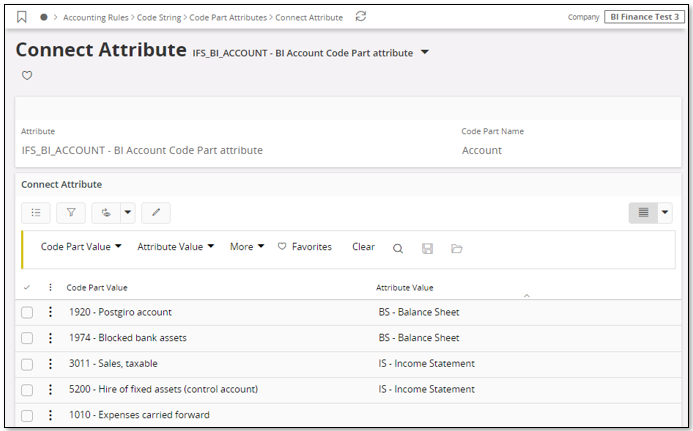

Code Part Attributes¶

The Financials model also supports Code Part Attributes.

One Code Part Attribute per code part is supported and to analyze more than one company it is necessary to define the same attributes in all these companies.

Code Part Attributes are defined for the selected source company in the pages Code Part Attributes, Attribute Value and Connect Attribute.

In the above example an attribute with identity IFS_BI_ACCOUNT has been defined for Account. The attribute has two attribute values, BS and IS, representing Balance Sheet and Income Statement accounts. For each attribute value the appropriate accounts are connected.

This Accounting Attribute definition can now be used in the Financial Tabular Model.

For more information please also refer to Data Configuration.

HR Headcount¶

In order to use the Employee Analysis model in the HR area, some basic data as well as Headcount Statistics Snapshots must be created.

Define an Age Group Class, an Employment Duration Class and the Period Calendar to be referenced when creating Headcount Snapshots. After that the necessary snapshots can be created. The model also supports up to two different Organization Structures.

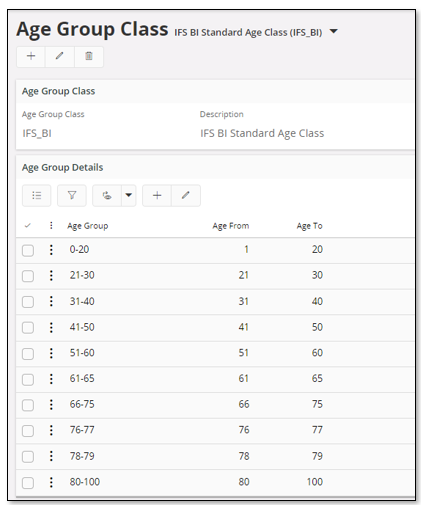

Age Group Class¶

In order to use the Headcount model, it is necessary to define one Age Group Class. Please refer to Data Configuration.

Use the page Age Group Class to define the necessary data.

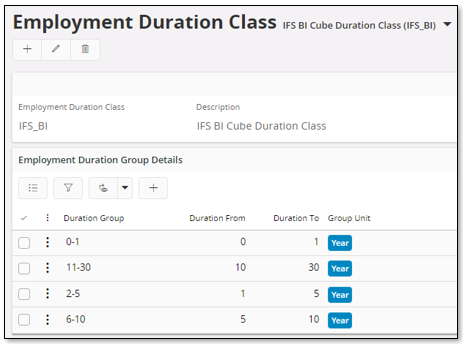

Employment Duration Class¶

In order to use the Headcount model, it is necessary to define one Employment Duration Class. Please refer to Data Configuration.

Use the page Employment Duration Class to define the necessary data.

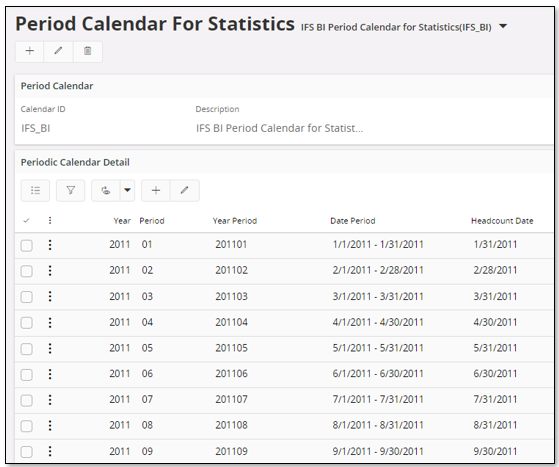

Period Calendar for Statistics¶

Use the page Period Calendar For Statistics to define the calendars to use.

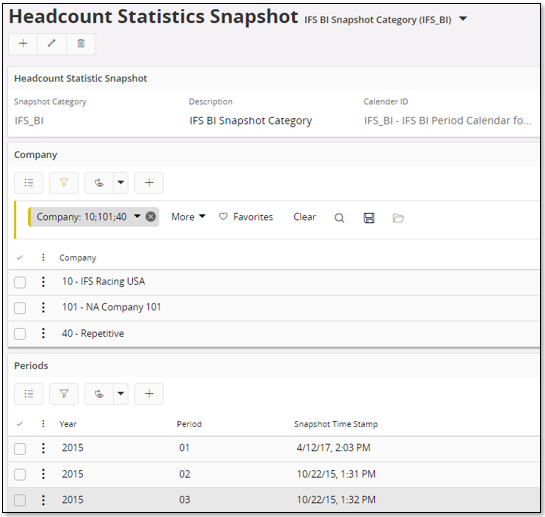

Headcount Snapshot Category¶

A Headcount Snapshot is created by using the page Headcount Statistics Snapshot. Each category references one Period Calendar. Make sure to connect the companies to be part of the snapshot before creating. Next the snapshots are created in the Periods** section.

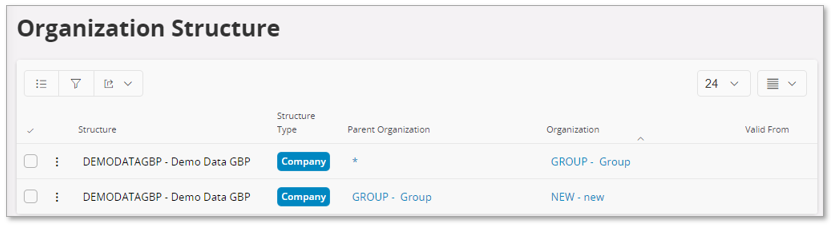

Organization Structure¶

The Employee Analysis model supports two different organization structures. Structures are defined using the Organization Structure page.