Analysis Models - Data Configuration¶

This page provides information how to define Analysis Models specific data configurations. These configurations are taken into account when the Tabular Models are processed, by filtering some of the available data in the SQL Server database. The purpose is to make sure that the Tabular Models work properly and provide a good user experience.

The configurations can be defined/changed via the IFS Cloud Web client and will be taken into account when the next transfer to SQL Server is made. Important to remember is that the configurations are represented by Tabular Data Sources of type Other, in most cases with an identity starting with the string " _LUP ". It must be made sure that these Tabular Data Sources are transferred on a regular basis.

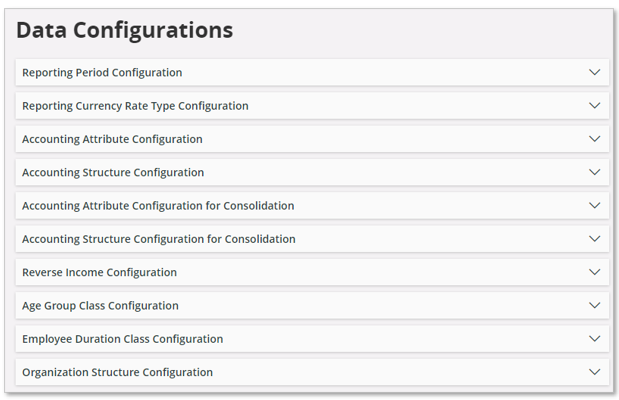

The data configurations are handled in the Data Configurations page under Analysis Models and Data Loads.

Please note that some configurations are not yet supported by delivered Tabular Models.

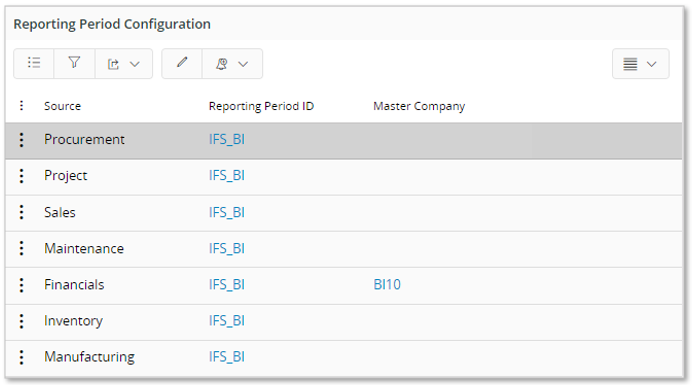

Reporting Period Configuration¶

IFS Cloud supports two dimensions that are based on Reporting Periods, DIM_RPD_PERIOD and DIM_RPD_COMPANY_PERIOD. Many of the Information Sources used by the Tabular Models have a relation to the dimension DIM_RPD_COMPANY_PERIOD, in the models named as REPORTING PERIOD. To be able to properly use that dimension, it is necessary to configure what Reporting Period ID that should apply for Information Sources in a special source category. There can be any number of Reporting Period definitions in IFS Cloud but to make the Tabular models useful, only one definition can be used,

It is recommended to always make sure that Reporting Period Configuration is defined properly before starting the SQL Server data load. For Financial model it is mandatory to set up this configuration.

The Source categories are predefined and the Reporting Period ID has a suggested value.

For each Source category, specify the Reporting Period ID to be considered by using List of Values with available values. If the predefined value is used, make sure that the Reporting Period definition has been properly set up in IFS Cloud.

If the Source category is Financials, then the Master Company must be supplied. It defines the company to be used to find Reporting periods that are added to the REPORTING DATE dimension. Thus, only one company controls the Reporting periods, not each individual company.

Also, note that the Master Company represents the master company in the Group Consolidation tabular model.

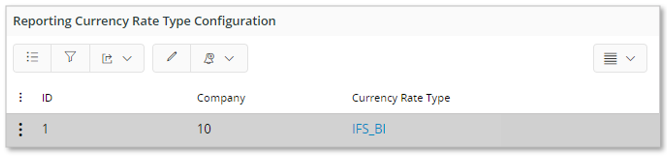

Reporting Currency Rate Type Configuration¶

A majority of the Tabular models support Reporting Currency, i.e. a way to recalculate amounts, originally represented in the company base currency, in any other currency by using a defined currency rate definition.

However, for the General Ledger (GL) model the currency calculations are a bit different. They are based on something called Cross Rates and any of the Currency Rate Types in the specified Company can be used for currency recalculations. Thus, for the GL model the provided Currency Rate Type is not used.

It is mandatory that Reporting Currency Rate Type Configuration is defined properly before starting the SQL Server data load.

Configuration is provided in the Reporting Currency Rate Type Configuration group.

The list has only one row and and will show pre-defined template values.

Modify the suggested values appropriately.

Read more about Basic Data for Tabular Models.

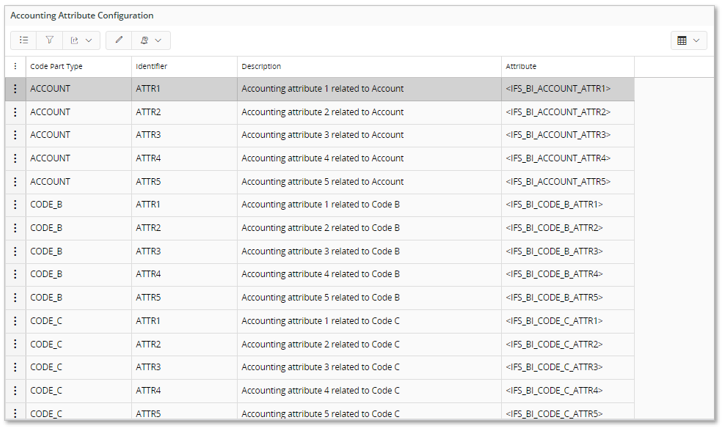

Accounting Attribute Configuration¶

The General Ledger model supports accounting attributes, a functionality in Accounting Rules that provides the possibility to group code part values and represent the group as an attribute value. One Attribute has a number of Attribute Values and each Attribute Value relates to one or more code part values. The main use case for the GL model is to use the Accounting Attributes to define code part mappings that only exists in Group Consolidation and make these mappings available in the GL model where they will appear as separate tables.

It is possible to configure up to 5 separate Attributes for each code part, i.e. for Account and Code B to Code J.

Configuration is provided in the Accounting Attribute Configuration group.

The field Attribute needs to be set for the attribute definitions to be considered in the model. List of Values supports a distinct list of available Attributes for the actual code part.

Note: The configuration is company independent which means that the attribute definitions in Accounting Rules need to be defined for all companies for which analysis/reporting based on accounting attributes in the GL model is planned.

Note: Only one attribute definition for Account and Code B is by default visible in the GL model. To make use of more attributes, it will be necessary to perform a configuration to unhide needed attribute tables in the model. Configurations can also be used to give the attribute tables and the table columns more user friendly names.

Read more about Basic Data for Tabular Models.

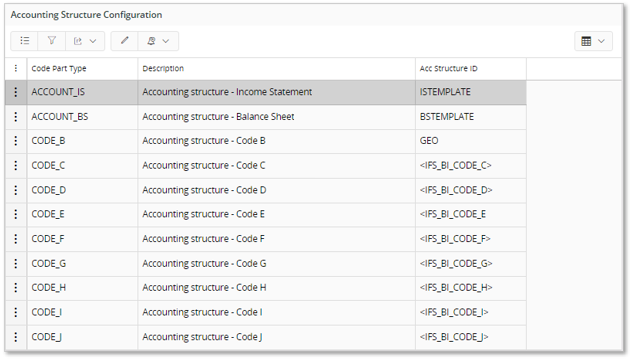

Accounting Structure Configuration¶

The General Ledger model supports accounting structures. The structures are defined in General Ledger where they are named Code Part Based Structures.

Configuration is provided in the Accounting Structure Configuration group.

List of Values for field Acc Structure ID supports a distinct list of available Accounting Structures for the actual code part.

For Account, two structure definitions are supported:

- Income Statement structure

- Balance Sheet structure

For the other code parts B -> J only one accounting structure definition is supported.

In the GL model the structures will appear as part of the associated code part table.

Note: The configuration is company independent which means that the structure definitions in Accounting Rules need to be defined for all companies for which analysis/reporting based on accounting structures in the GL model is planned.

Read more about Basic Data for Tabular Models.

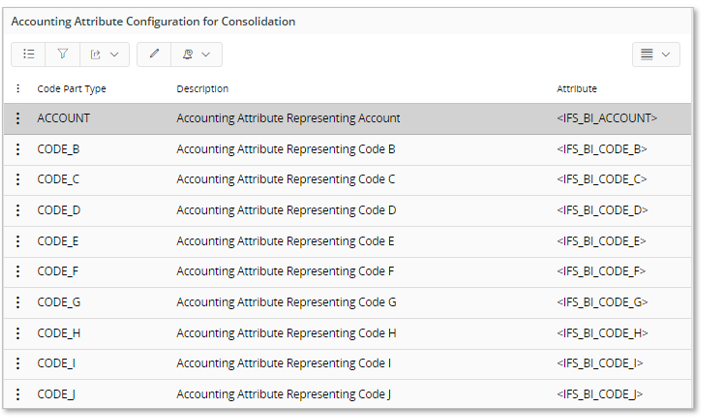

Accounting Attribute Configuration for Consolidation¶

The Group Consolidation model supports accounting attributes, a functionality in Accounting Rules that provides the possibility to group code part values and represent the group as an attribute value. One Attribute has a number of Attribute Values and each Attribute Value relates to one or more code part values.

One Attribute can be defined per code part, i.e. for Account and Code B to Code J.

Configuration is provided in the Accounting Attribute Configuration for Consolidation group.

The field Attribute needs to be set for the attribute definitions to be considered in the model. List of Values supports a distinct list of available Attributes for the actual code part.

Note: The configuration is company independent which means that the attribute definitions in Accounting Rules need to be defined for all companies for which analysis/reporting based on accounting attributes in the GC model is planned.

Read more about Basic Data for Tabular Models.

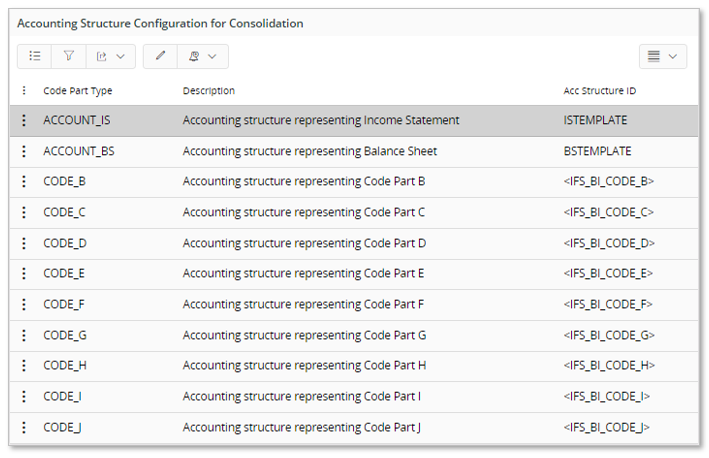

Accounting Structure Configuration for Consolidation¶

The Group Consolidation model supports accounting structures. The structures are defined in General Ledger where they are named Code Part Based Structures.

Configuration is provided in the Accounting Structure Configuration for Consolidation group.

List of Values for field Acc Strucutre ID supports a distinct list of available Accounting Structures for the actual code part.

For Account, two structure definitions are supported:

- Income Statement structure

- Balance Sheet structure

For the other code parts B -> J only one accounting structure definition is supported.

In the GC model the structures will appear as part of the associated code part table.

Note: The configuration is company independent which means that the structure definitions in Accounting Rules need to be defined for all companies for which analysis/reporting based on accounting structures in the GC model is planned.

Read more about Basic Data for Tabular Models.

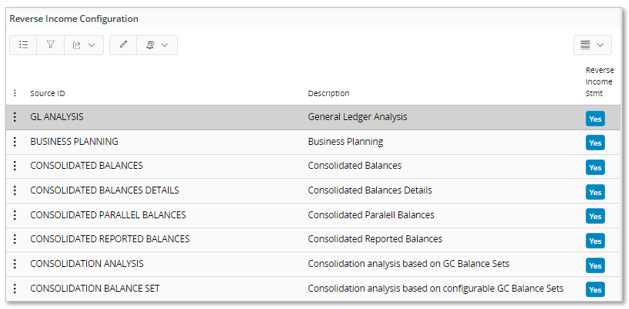

Reverse Income Configuration¶

Amounts in Financials are handled according to standard accounting principles, meaning that a positive revenue is stored as a negative number. The way that amounts are stored is often not suitable for reporting and analysis scenarios.

The tabular framework supports a way to configure amounts related to income statement accounts, i.e. costs, revenues and statistical accounts.

Configuration is provided in the Reverse Income Configuration group.

The Source ID represents the name if a source table in either the GL or GC model.

By default the Reverse Income Stmt is set to Yes.

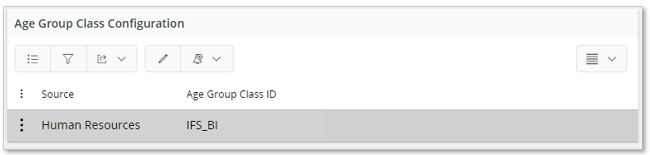

Age Group Class Configuration¶

For Human Capital Management model it is required to choose one age group class for the Age Group dimension and this is handled by the configuration provided in the Age Group Class Configuration group.

The Source represents the area that the configuration applies to.

By default the Age Group Class ID is defined as the template name

List of Values supports a list of available age group classes.

Read more about Basic Data for Tabular Models.

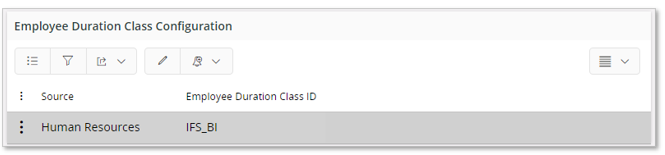

Employee Duration Class Configuration¶

For Human Capital Management model it is required to choose one employee duration class for the Current Employment Duration dimension and this is handled by the configuration provided in the Employee Duration Class Configuration group.

The Source represents the are that the configuration applies to.

By default the Employee Duration Class ID is defined as the template name

List of Values supports a list of available employee duration classes.

Read more about Basic Data for Tabular Models.

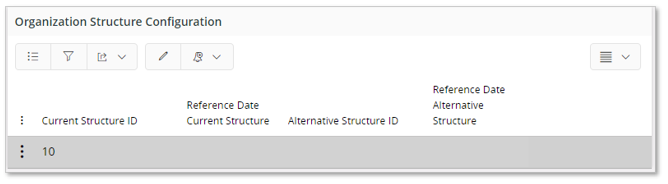

Organization Structure Configuration¶

The Human Capital Management model supports the possibility to use two Organization Structures.

The structures to be available in the model are configured using the Organization Structure Configuration group.

Two structures are can be configured.

- Current Structure ID Mostly used as the regular structure within the organization. Available in the model via the table ANALYSIS STRUCTURE - CURRENT.

- Alternative Structure ID This structure can be used for a matrix organization or to compare the current structure with a historical organization structure. Available in the model via the table ANALYSIS STRUCTURE - ALTERNATIVE.

The reference dates, Reference Date Current Structure and Reference Date Alternative Structure, can be used to configure if a structure should be extracted as it looked at the reference date. If no reference date is given, a structure is transferred as it looks at the time when transferred to the data storage.