AvaTax Brazil Installations¶

Purpose of this page is to describe Avalara Brazil (AvaTax Brazil) installation in detail.

When to use this information:

When the necessary IFS components are installed, this guide describes how to install Avalara Brazil (AvaTax Brazil) integration.

Routing Rules¶

There are two Outbound Routing Rules introduced for Avalara Brazil

-

Example_Avalara_Brazil_Authorization

-

Example_Avalara_Brazil_Tax_Calculation_Service

Setup Routing Address¶

There are two Routing Addresses with the names same as Routing Rules.

The Rest Root Endpoint information in Routing Addresses should be filled in with the information received from Avalara Brazil.

Example Rest Endpoint - https://avataxbr.sandbox.avalarabrasil.com.br/v3/calculations

Setup Authentication Details¶

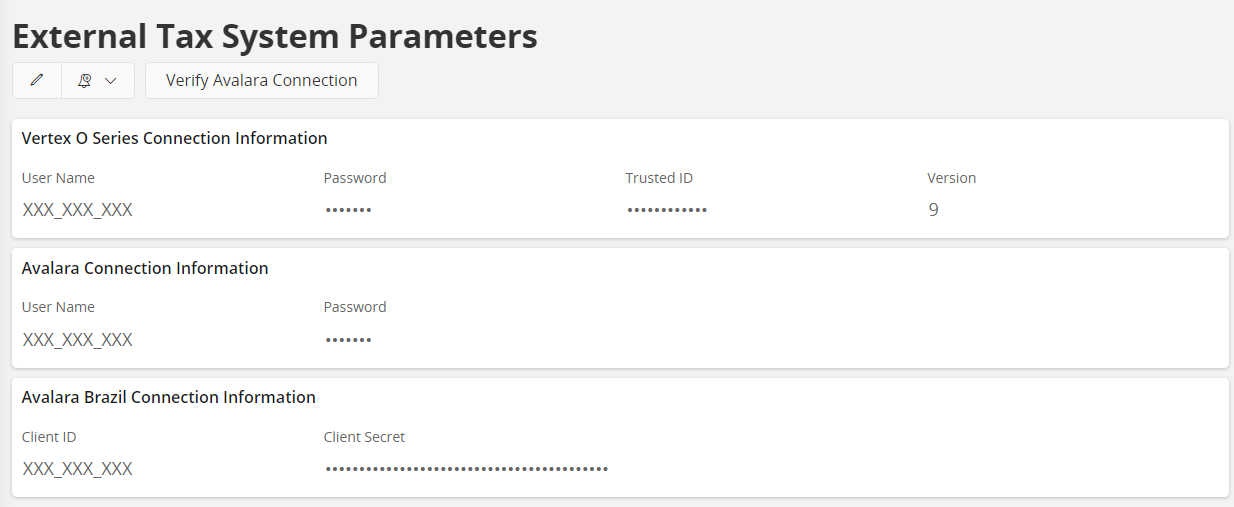

Authentication details can be entered in section Avalara Brazil Connection Information in Application Base Setup / Enterprise / Tax / External Tax Systems / External Tax System Parameters page as follows.

Client ID and Client Secret can be obtained from the Avalara Brazil portal once the customer subscribes to AvaTax Brazil services.